Semimonthly payroll calculator

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. A semi-monthly gross pay of 2000 equates to a daily rate of 13333 in a pay period with 15 days.

The Pros And Cons Biweekly Vs Semimonthly Payroll

Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as.

. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. You can calculate this by dividing the 2080workdayss by the 24 semi-monthly payrolls. No Need to Transfer Your Old Payroll Data into the New Year.

Total the Hours Worked for the Week 3. As a result of this salaried employees are paid for 8667 hours each semi-monthly pay period. Semimonthly payroll produces 24 consistent paychecks per year.

Calculate and Divide Multiply hours worked by your hourly rate. Ad Start Afresh in 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Employers can use it to calculate net pay and figure out how. Get Started With ADP Payroll.

In a pay period with 16 days the daily rate would be 125. Pay Period Beginning Date. Ad GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software.

Hourly employees multiply the total hours worked by the hourly rate plus overtime and. Semimonthly payroll for salaried exempt employees is straightforward. Semimonthly payroll is a payment schedule where employees are paid twice a month.

Here When it Matters Most. All Services Backed by Tax Guarantee. Ad Process Payroll Faster Easier With ADP Payroll.

All semi-monthly paydays are the 5th working day after the end of the pay period. Computes federal and state tax withholding for. To calculate an employees gross pay start by identifying the amount owed each pay period.

The firm distributes wages either on the 1 st and the 15 th day of every month or on the 1 st and last day. On a semimonthly schedule the employees gross pay per paycheck would be around 229167. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

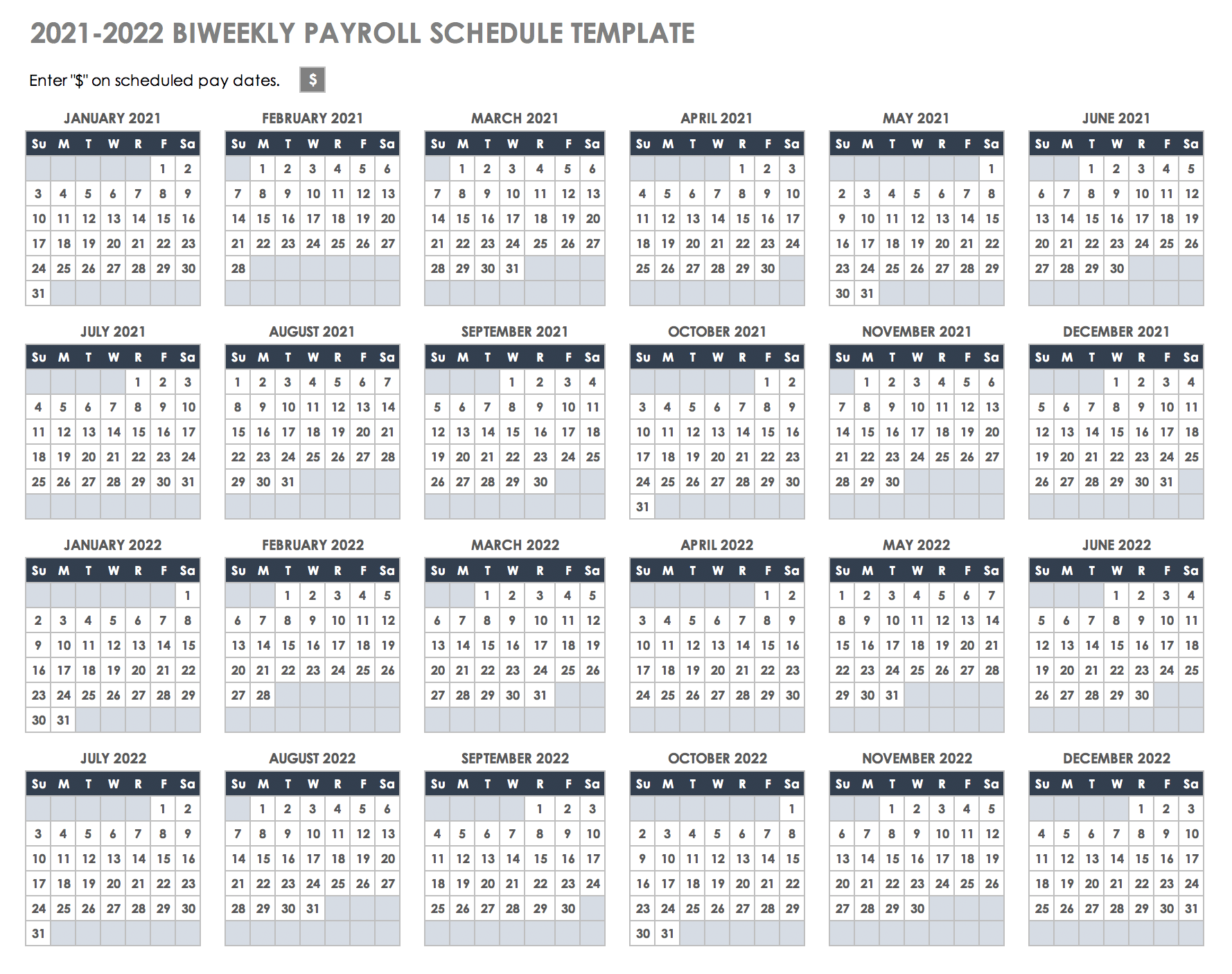

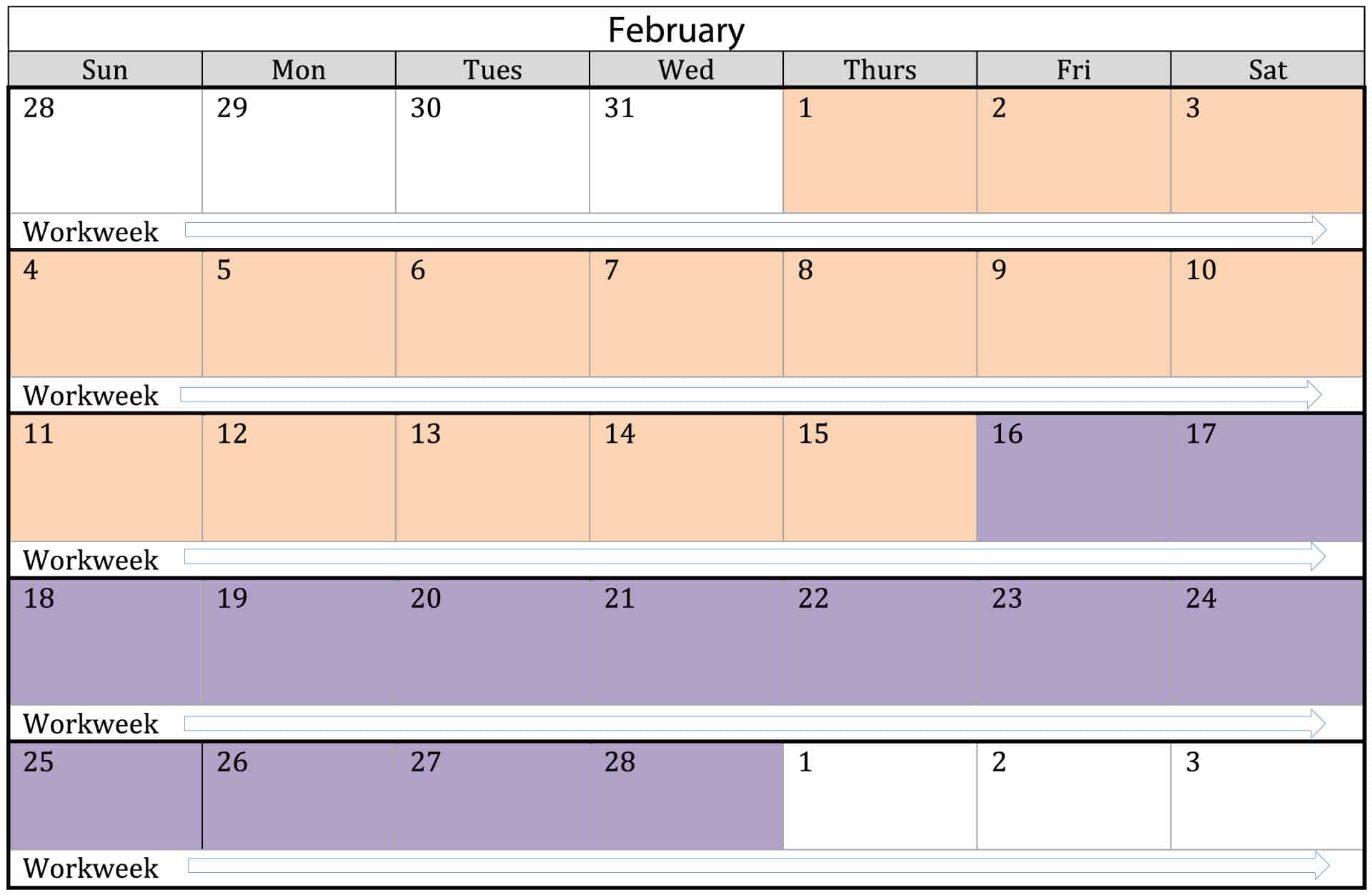

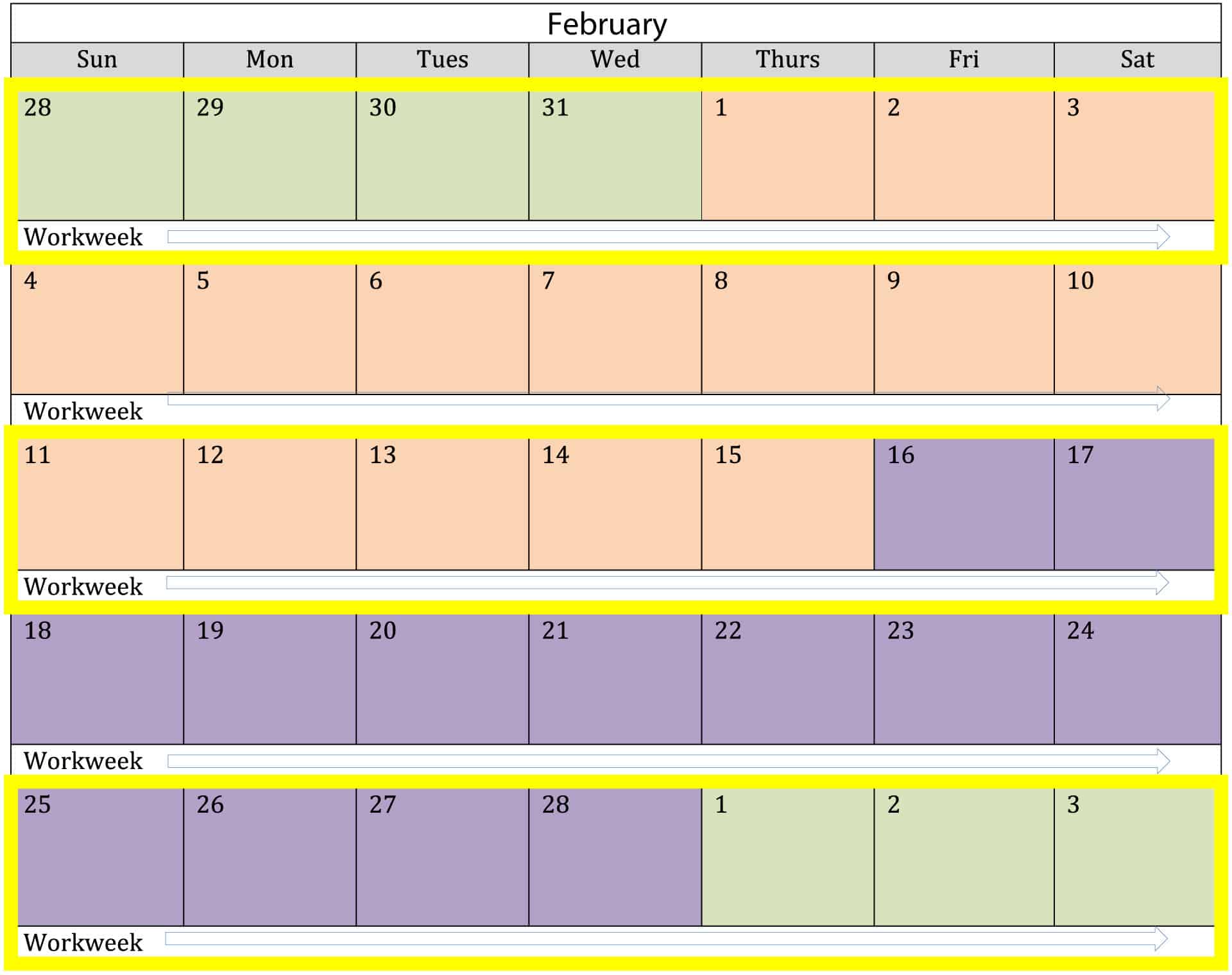

2022 Semimonthly Payroll Calendar This calendar applies to all salary employees. On a biweekly schedule the employees gross pay per paycheck would be. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

The salary calculator converts your salary to equivalent pay frequencies including hourly daily weekly bi-weekly monthly semi-monthly quarterly and yearly. Salaries are divided into 24 pay. Free Unbiased Reviews Top Picks.

Ad Compare This Years Top 5 Free Payroll Software. Discover ADP Payroll Benefits Insurance Time Talent HR More. Compare Side-by-Side the Best Payroll Service for Your Business.

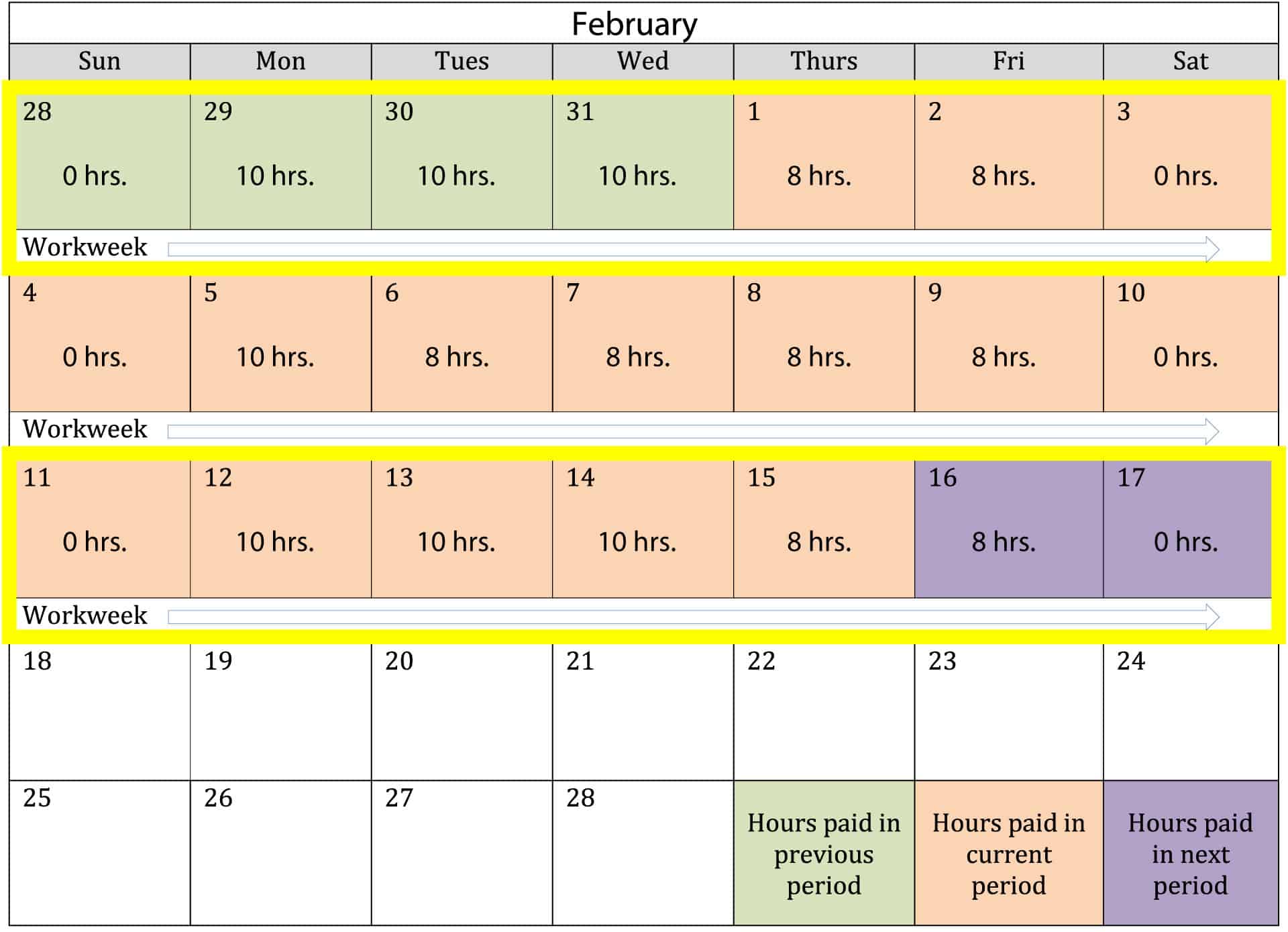

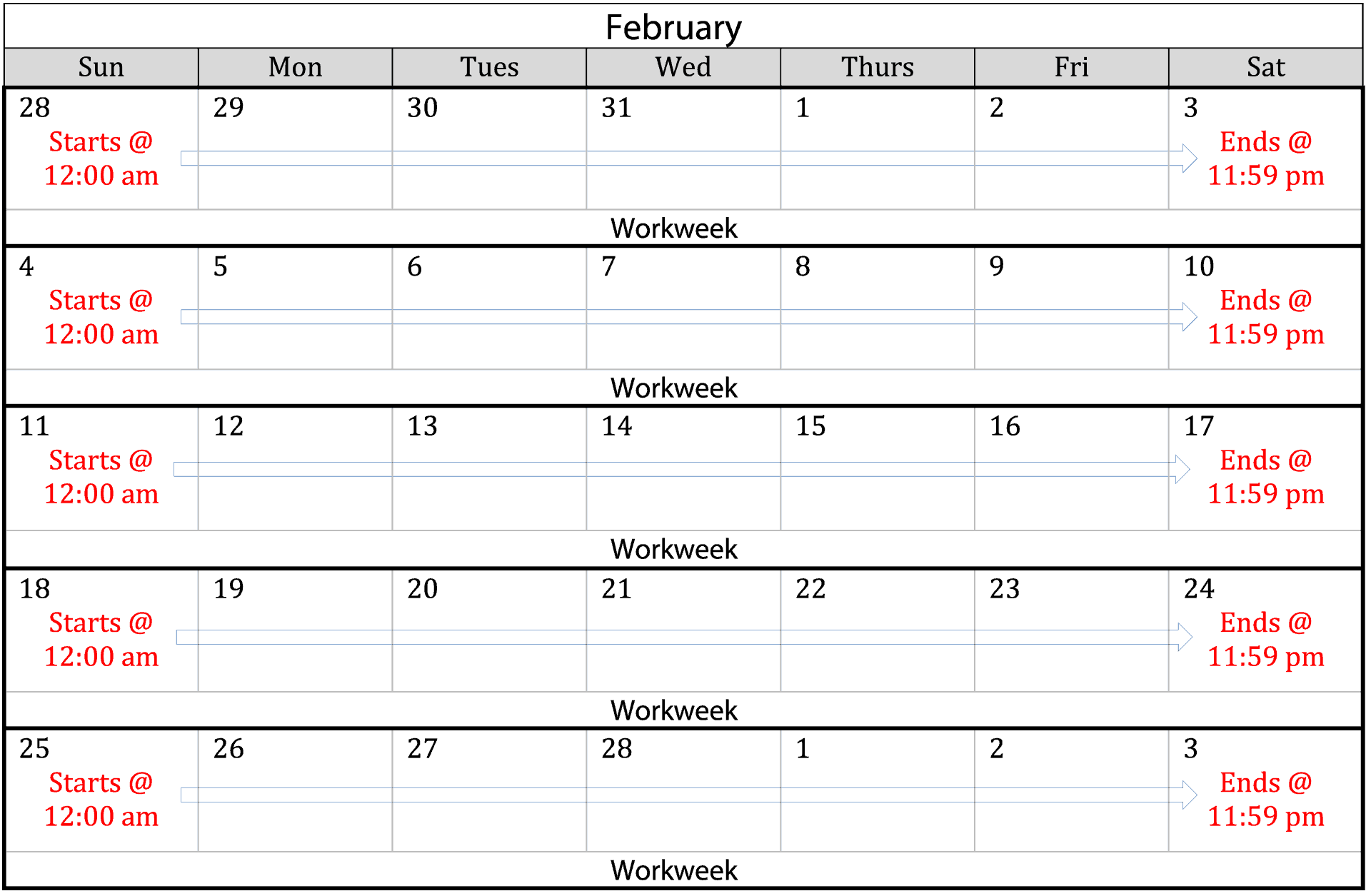

How to Calculate a Semi-Monthly Paid Employees Daily Rate How to Calculate Overtime for a Semi-monthly Payroll 1. Ad Process Payroll Faster Easier With ADP Payroll. Pay Period Ending Date.

Examples of payment frequencies include biweekly semi. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Federal Salary Paycheck Calculator.

Separate into Workweeks 2. Get Started With ADP Payroll. Tentative dates Subject to change based upon CCS Holiday closing dates.

Get the Payroll Tools your competitors are already using - Start Now. Customized Payroll Solutions to Suit Your Needs. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Get Started for Free. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you. Dividing the total yearly salary by 12 will give you the gross pay for each month.

15 Free Payroll Templates Smartsheet

Elaws Flsa Overtime Calculator Advisor

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

How To Do Payroll In Excel In 7 Steps Free Template

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Formula Step By Step Calculation With Examples

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Calculate Retroactive Pay Payroll Management Inc

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Semi Monthly Timesheet Calculator With Overtime Calculations

How To Do Payroll In Excel In 7 Steps Free Template

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Formula Step By Step Calculation With Examples